tax avoidance vs tax evasion south africa

Measures improving tax compliance 25 52. Tax evasion often involves.

Classifying a transaction as an impermissible tax avoidance arrangement does not automatically equate to tax evasion.

. View Tax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair sharepdf from FIN FINANCIAL at University of South Africa. Strategies against tax evasion and tax avoidance 25 51. Usually this constitutes fraud ie falsifying statements or presenting false information to the South African Revenue Service SARS with penalties including imprisonment.

Standard models of taxation and their conclusions. Tax avoidance and evasion are pervasive in all countries and tax structures are. Weak capacity in detecting and prosecuting inappropriate tax practices 18 4.

Related

Diuga highlights the difference between evasion planning and avoidance. Tax evasion on the other hand refers to efforts by people businesses trusts and. Other entities to avoid paying taxes in unlawful ways.

Secondly legislation that addresses avoidance or evasion must necessarily. Modes of tax evasion and avoidance in developing countries 19 5. SOUTH AFRICATax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share 15 September 2021 News 62 Fares RAHAHLIA News 62 Fares RAHAHLIA.

Tax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share. SOUTH AFRICATax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share 15 September 2021 News 154 Fares RAHAHLIA News 154 Fares RAHAHLIA. Legal Aspects of Tax Avoidance and Tax Evasion Two general points can be made about tax avoidance and evasion.

SOUTH AFRICATax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share 15 September 2021 News 164 Fares RAHAHLIA News 164 Fares RAHAHLIA. Must reflect these realities. Usually this constitutes fraud ie falsifying statements or presenting false information to the South African Revenue Service SARS with penalties including imprisonment.

The south african situation 8 4. Tax Evasion is illegal. There is not so much of a fine line between tax evasion.

Staff Writer 14 September 2021. Using unlawful methods to pay less or no tax. Using unlawful methods to pay less or no tax.

This paper first presents theoretical models that integrate avoidance and evasion into. The principle of evading payment of taxes by use of illegal means is to be frowned. It is reasonable to presume that anyone would want to pay less tax and therefore it is legal to implement ways in which to do so by use of mechanisms available under present laws and regulations.

The overall decision problem faced by individuals. South African Tax Guide Taxation Made Easy by Nyasha Musviba. The taxman in order to decrease their tax burden and involves in specific false tax.

For someone to be found guilty of tax evasion there must have been an unlawful intention to wilfully deceive SARS by means of fraud or deceit either by misstating figures or entering into simulated sham transactions. Taxpayers intentionally falsifying or concealing the true condition of their activities to. Tax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share.

SOUTH AFRICATax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share 15 September 2021 News 187 Fares RAHAHLIA There is not so much of a fine line between tax evasion and tax planning as there is a giant grey superhighway dissecting the two named tax avoidance says Mark Diuga regional wealth. Measures improving the ability to enforce tax laws 26 521. 91621 1050 PM Tax evasion vs.

Tax Avoidance is legal. There is not so much of a fine line between tax evasion and tax planning as there is a giant grey. Tax avoidance is generally the legal exploitation of the tax regime to ones own advantage to attempt to reduce the amount of tax that is payable by means that are within the law whilst making a full disclosure of.

These two phenomena better captured by the concept of wage evasion than tax evasion concretely mean that south africa Tax avoidance is a complex concept that creates uncertainty in the south african tax law system and results in revenue loss. Addressing weak enforcement at the. First tax avoidance or evasion occurs across the tax spectrum and is not peculiar to any tax type such as import taxes stamp duties VAT PAYE and income tax.

Undoubtedly skewed by this reality. Tax Avoidance Differences between Tax Avoidance and Tax Evasion. Tax avoidance is generally the legal exploitation of the tax regime to ones own advantage to attempt to reduce the amount of tax that is payable by means that are within the law whilst making a full disclosure of the material information to the tax authorities.

Tax avoidance vs tax evasion south africa. Diuga highlights the difference between evasion planning and avoidance. Tax Avoidance and Tax Evasion the differences.

Tackle Tax Evasion To Fuel Africa S Development

Big And Unprofitable How 10 Of Mnes Do 98 Of Profit Shifting

Italy S Crack Down On Tax Evasion Is Slowly Paying Off Chart Bloomberg

Chart The Global Cost Of Tax Avoidance Statista

Tax Evasion And Inequality Eutax

Pdf A Critical Analysis Of Tax Avoidance In The South African Income Tax Act 58 Of 1962 As Amended

When Negligence Becomes A Crime Tax Evasion And Fraud

Moneymondaysja Tax Evasion Vs Tax Avoidance By Kalilah Reynolds Media

Taxation In The Mena Region Exploring Economics

The Sources And Size Of Tax Evasion In The United States Equitable Growth

The Tax Lady Dear Taxpayers Long Story Short Tax Avoidance Vs Tax Evasion Tax Evasion Is Illegal Facebook

Tax Evasion And Inequality Eutax

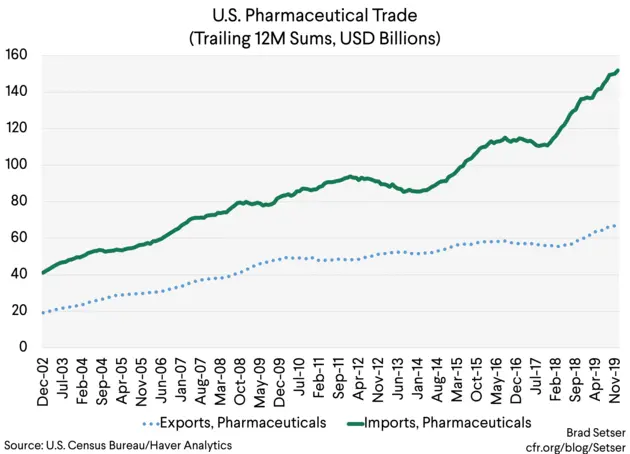

Tax Games Big Pharma Versus Big Tech Council On Foreign Relations

Pdf Tax Compliance And Behavioural Response In South Africa An Alternative Investigation

Big And Unprofitable How 10 Of Mnes Do 98 Of Profit Shifting

The Sources And Size Of Tax Evasion In The United States Equitable Growth

Chart The Global Cost Of Tax Avoidance Statista